The Government of Rajasthan is taking several steps to empower women and support them in becoming self-reliant. One such important step is the launch of the Indira Mahila Shakti Udyam Protsahan Yojana, a scheme specially designed to promote women entrepreneurship in the state. This scheme provides financial assistance in the form of loans with subsidies to encourage women to start their own businesses and generate employment. In this article, we will explain the key features, benefits, eligibility, application process, and objectives of the Indira Mahila Shakti Udyam Protsahan Yojana in simple and clear language for the general public.

Indira Mahila Shakti Udyam Protsahan Yojana

The Indira Mahila Shakti Udyam Protsahan Yojana (IMSUPY) is a women empowerment scheme launched by the Department of Women and Child Development, Government of Rajasthan. It aims to provide financial help in the form of interest-free or low-interest loans to women who want to start or grow their businesses. The main goal of this scheme is to support women-led micro and small enterprises and encourage them to become financially independent.

This scheme not only supports new women entrepreneurs but also helps existing women-run businesses that need funding for expansion, working capital, or infrastructure. It is part of the broader initiative under the Indira Mahila Shakti Nidhi, which is focused on improving the socio-economic status of women in Rajasthan.

Objectives of the Scheme

- To provide financial support to women for starting or expanding their businesses

- To promote self-employment and entrepreneurship among women

- To create more job opportunities for women in Rajasthan

- To support women from economically weaker sections of society

- To reduce financial barriers that prevent women from entering the business sector

Key Features and Benefits

- Women can take loans from ₹50,000 up to ₹5 lakhs

- Loans are provided with 0% interest or a heavily subsidized interest rate

- No collateral security is required for small loans

- Preference is given to women from self-help groups (SHGs) and those belonging to Scheduled Castes (SC), Scheduled Tribes (ST), Other Backward Classes (OBC), Minority, and Below Poverty Line (BPL) categories

- The loan can be used for business setup, expansion, infrastructure, machinery, or working capital

- Repayment period is flexible and easy

- Helps in building a strong network of women entrepreneurs across Rajasthan

Who Can Apply – Eligibility Criteria

To apply for the Indira Mahila Shakti Udyam Protsahan Yojana, a woman must meet the following eligibility criteria:

- The applicant should be a woman resident of Rajasthan

- She should be above 18 years of age

- She must have a plan to start or expand her own business

- Women belonging to economically weaker sections or from marginalized communities are given preference

- She should not be a defaulter in any previous government or bank loan

- Existing women-led businesses are also eligible for expansion loans

Documents Required

Applicants will need the following documents to apply for the scheme:

- Aadhar Card

- Residence Certificate of Rajasthan

- Caste Certificate (if applicable)

- Passport-size photo

- Income Certificate

- Business Proposal or Project Report

- Bank account details

- Self-Help Group (SHG) membership details (if any)

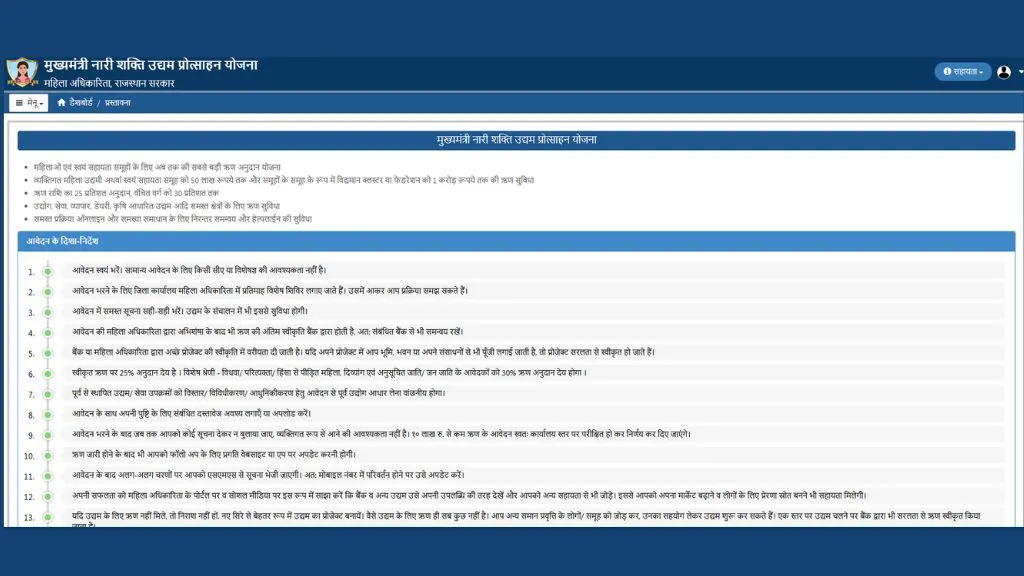

How to Apply for Indira Mahila Shakti Udyam Protsahan Yojana

Women interested in applying for the scheme can follow the steps given below:

- Go to the official website of the Women and Child Development Department, Rajasthan or visit your nearest district-level Mahila Shakti Kendra or WCD Office.

- You can either download the application form from the official website or collect it from the concerned government office.

- Fill out the form with correct details such as personal information, business plan, bank account, and loan amount required.

- Attach all the necessary documents including ID proof, income certificate, and project report.

- Submit the filled form and documents to the concerned department or office. You will receive an acknowledgment or reference number.

The application will be reviewed by the authorities. If approved, the loan will be sanctioned and disbursed directly to your bank account.

Departments Involved

The implementation of this scheme is mainly handled by the following departments:

- Women and Child Development Department, Rajasthan

- Rajasthan Mahila Nidhi (Women’s Fund)

- District Collector Offices

- Banks and Financial Institutions in partnership with the government

Importance of the Scheme for Women in Rajasthan

This scheme is very important for women who want to become financially independent but face problems like lack of capital, lack of support, and high-interest loans from private lenders. By offering government-backed loans with no or very low interest, the scheme makes it easier for women to take the first step toward entrepreneurship. It also promotes gender equality and helps in reducing poverty by improving the income of women-led households.

Success Stories and Impact

Since its launch, many women in Rajasthan have benefited from this scheme. Women have started businesses like tailoring units, beauty parlors, small shops, food services, dairy farming, and other home-based enterprises. These businesses not only support them financially but also help them employ other women in their community.

FAQs About Indira Mahila Shakti Udyam Protsahan Yojana

Any woman who is a resident of Rajasthan and wants to start or expand her business can apply.

Women can get loans up to ₹5 lakhs under this scheme.

The scheme provides loans at 0% or very low interest, depending on the category and loan amount.

You can apply through the Women and Child Development Department or visit the nearest Mahila Shakti Kendra in your district.

The Indira Mahila Shakti Udyam Protsahan Yojana is a powerful step toward building a strong, self-reliant, and empowered community of women entrepreneurs in Rajasthan. With easy access to loans and government support, more women can now fulfill their dream of starting a business and improving their financial status. If you or someone you know is planning to start a small business, this scheme can be a great opportunity to turn that dream into reality.